3 Predictions for the 2022 Housing Market

This article was originally published by Mike Simonsen on Housingwire.com

As we approach the end of another hot year for the market, homebuyers and sellers are eagerly looking ahead to the 2022 housing market. Will the market continue its streak of strong growth, or are we finally about to see a slow down?

Here’s a high-level forecast for what to expect next year, based on the supply and demand signals we can already see in today’s data. I’ll also highlight which variables we should be watching for unexpected market shifts.

1. Housing market demand will continue to be strong into 2022

The first signal we look at to forecast the strength of the housing market is days on market – how fast are homes moving? Right now, we’re seeing a median of 49 days on market and climbing, as it normally does this time of year. A typical December would see market time at 85-100 days, so you can see from the chart that demand is staying elevated later in the year, which is a bullish sign for next year.

YOU MIGHT WANT TO READ: What to do when your offer to purchase a home is denied

A typical December would see market time at 85-100 days, so you can see from the chart that demand is staying elevated

Due to the strong seasonal patterns, I predict days on market will hit a low of 21 days in April, tying the record-fast market times from earlier this year.

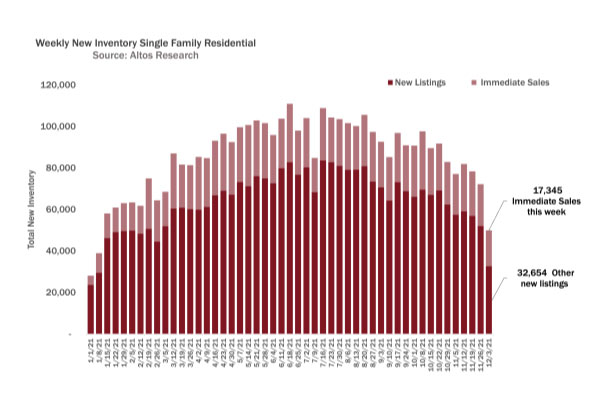

With homebuyer demand off the charts earlier this year, Altos Research began tracking the phenomenon we call “immediate sales.” You’ve probably seen this in your local market, where offers happen more or less immediately after the home gets listed for sale. At this moment, about 25% of properties are going into contract essentially immediately every week (around 20,000 of them within hours or days of listing) — even as supply and transaction volume declines through the end of the year.

I actually expected immediate sales to be dropping at this point, but it isn’t. Even over the Thanksgiving holiday, total volumes were down, but immediate sales as an indicator of demand were still dominant. The fact that this trend is continuing unabated into the winter indicates continued strong demand into next year.

Even over the Thanksgiving holiday, total volumes were down, but immediate sales as an indicator of demand were still dominant.

That being said, if the housing market turns, immediate sales will be one of the first places we’ll be able to see it. For example, if buyers are cooled by higher interest rates, the first thing that’s going to happen is they’re not going to make those immediate offers.

Since it will take several months for rates to rise high enough to discourage buyers, we can expect immediate sales and all the related buyer competition characteristics (multiple offers, over-bidding) to remain common well into at least the second quarter of 2022.

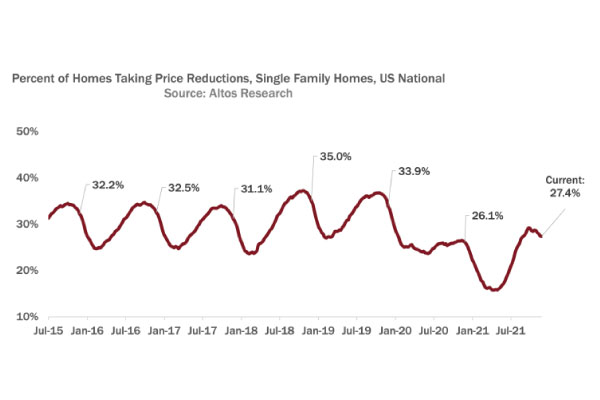

Another signal pointing to continued elevated demand is the percent of homes on the market taking price reductions. In a normal market, we tend to see about 30% to 35% of sellers initially over-price their homes and eventually reduce the price to attract buyers.

Right now price reductions are at 27%, and starting to tick down again after the fall peak in September. You can see that it’s higher than last year, but still lower than normal. Home sellers with properties on the market now know that the demand is there, and they don’t have to cut their prices. This tells us that the transactions for these homes that happen in the first quarter will still be priced very strongly.

WE RECOMMEND: How climate change is leading to more equitable housing

Another signal pointing to continued elevated demand is the percent of homes on the market taking price reductions.

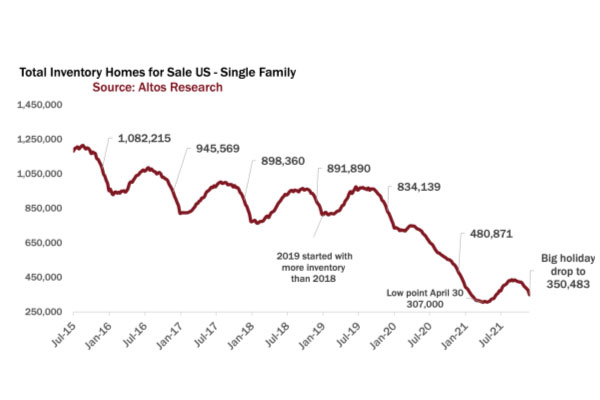

2. Housing market inventory will continue to be a major issue in 2022

Unfortunately for all these eager homebuyers, inventory continues to be at record low levels. We are currently at just over 350,000 single-family homes on the market. You can see from this chart that inventory has been on a downward trajectory for years, and recent strong demand has only accelerated this trend. You can also see that it’s normal for inventory to drop at this time of year, but it’s actually declining faster than I expected even a few weeks ago, which indicates that we’ll start 2022 with record- low levels of available inventory, even less than in 2021.

YOU MIGHT LIKE THIS: 4 Easy Ways to Refinance Your Home Loan

It’s normal for inventory to drop at this time of year, but it’s actually declining faster than I expected even a few weeks ago,

At this point, it looks like we’re going to end the year at just under 300,000 single-family homes for sale. If we’re lucky, we’ll start getting greater inventory in the housing market in February, then it’ll start climbing and be at a more normal curve next year, but we’re still miles away from a normal level, with no indication that we’ll return to our usual million homes anytime soon.

That being said, keep an eye on rising interest rates. If you look at the 2018 line in the inventory chart, you’ll see that inventory hadn’t yet declined by this time of year in 2018. Why? Because interest rates rose from around 3.9% to 4.9% between April and December, and that cooled the market enough that a little bit of inventory built up during 2018. You can see that 2019 was the only recent year that started with more inventory than the year before.

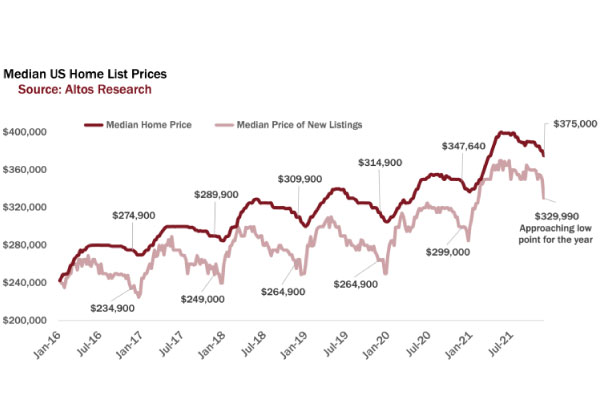

3. Home prices will remain high into 2022

With demand showing no signs of cooling and record-low inventory, I expect home prices to remain high into next year. The median home price for single family homes this week is $375,000, which is about 10% higher than last year and where we are likely to end the year.

THIS MIGHT BE INTERESTING: Applying for a mortgage when you’re self-employed

If we’re lucky, we’ll start getting greater inventory in the housing market in February, then it’ll start climbing and be at a more normal curve next year.

As we look towards 2022, all the leading indicators show tight inventory and strong demand keeping prices high — a strong seller’s market. If interest rates start rising, and we’re seeing inflation or other economic challenges, this could have a cooling effect on the market. These variables aren’t in the data yet, but they’re looming. We’ll want to keep watching the data closely to spot any major shifts.