How Does The Loan Amortization Work?

Have you ever wondered what portion of your mortgage payment goes towards paying down the principal loan balance? The answer is that it changes slightly on every payment you make due to a concept called amortization.

Understanding Payments

In general, mortgage loans are frontloaded with interest. This means that the earlier payments during the term of the loan have a much larger percentage of the payment going towards interest than paying down the principal. This is also common for most types of financing.

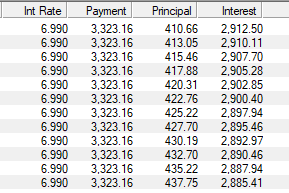

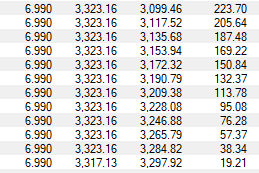

To illustrate, here is a comparison between the first year of a $500,000 for a 30-year fixed mortgage loan term at an interest rate of 6.99% vs. the final year (year 30):

WE RECOMMEND: 3 Steps to Getting Pre-Approved for a Mortgage

Year 1

Year 30

Have you ever wondered what portion of your mortgage payment goes towards paying down the principal loan balance?

Amortization Schedule

In the first year after making 12 mortgage payments totaling just under $40,000, only a little over $5,000 in principal reduction is made. In the final year of paying the same $40,000 in mortgage payments, almost $35,000 is applied toward principal reduction.

Amortization is an important concept to understand and DG Pinnacle Home Loans provides every borrower a full amortization schedule for their mortgage prior to the loan closing.

Bottom Line

The process of buying a home may be demanding, but it can also be one of the most rewarding ventures of your life. Remember, patience and a positive attitude will go a long way in making this journey a memorable and exciting one.

If you have questions about the loan process or how to get started, feel free to contact us

One of our Loan Officers will be pleased to help you.

This article was originally published by Anthony Duval in www.bluefiremortgage.com